While new medical cannabis dispensary locations in D.C. are popping up across the city, growers and manufacturers have been left behind despite going through the licensing process months before retailers.

Over 120 businesses in both manufacturing and cultivation categories applied last year, but not a single new manufacturer or cultivator has opened in the District. In contrast, four new medical dispensaries have opened and seven are licensed and pending opening.

In June, DC XTRACTS LLC became the first new operator to receive a license, but they still have not opened. Applicants are struggling to find locations that are appropriately zoned and large enough to secure investors.

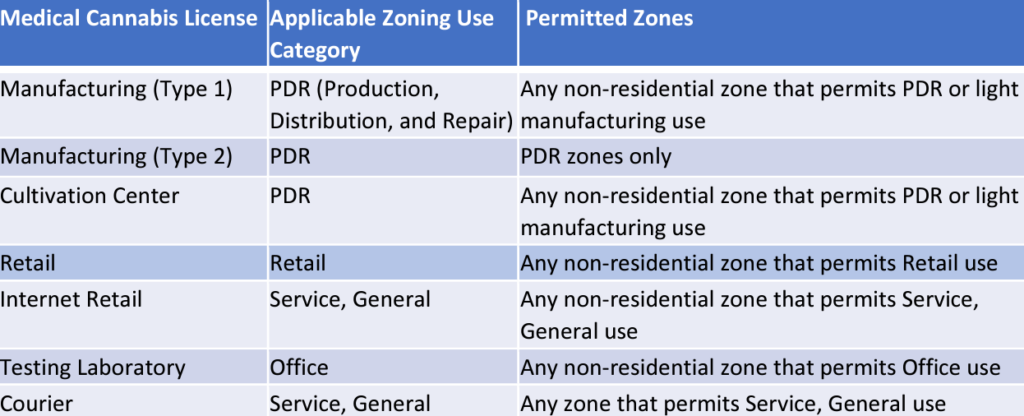

D.C. Council extended the 12-month conditional license period by a year last month, and the D.C. Department of Buildings (DOB) zoning released guidance in May that expanded where Type 1 medical manufacturer and cultivation licensees can operate, addressing the lack of real estate available. This zoning expansion did not effect Type 2 cultivators or manufacturers.

“With real estate inventory already being extremely limited for [cultivational and manufacturer] licensees, the PDR policy made it even more improbable that a manufacturer or cultivation center license applicant would be able to identify compliant property for their operations,” lawyer Meredith Kinner of Kinner and McGowan, a D.C. cannabis firm, said.

“As a result, zoning did not acknowledge these new licensees and implemented a policy to only allow these manufacturers to operate in PDR zones,” Kinner added.

Kinner said that the Alcohol Beverage and Cannabis Administration (ABCA) worked with DOB to release new guidance that opened up a few dozen new zones. The guidance allows Type 1 businesses to locate in Downtown zones, D-3 to D-8, St. Elizabeth’s East zone, StE-1 to StE-18, and a few Mixed-Use and CG zones.

But since that change over a two months ago, only five new businesses have received placards, the next step in getting licensed.

That means that the cultivation and manufacturer licensees have less than a 5% success rate in D.C.’s medical cannabis expansion as of July 2024. Before the zoning change, there had been no licensee that moved forward in the process from the conditional stage.

The Outlaw talked with multiple applicants that have run into dead ends finding real estate that is appropriately zoned and the right size to produce enough product to justify investors.

Bryan Jackson received a conditional cultivation license last year, but he recently stopped looking for property after two locations fell through due to school proximity and sellers raising the price.

Jackson said he was not aware of the zoning change or the conditional license extension until the Outlaw contacted him. He did not know the zoning change had taken place, so it has not helped him find a new location. “I didn’t get anything written from ABCA,” he said. “This is the first I am hearing of it.”

He said ABCA has been responsive but has not sent any “definitive” responses to his questions on zoning.

Jackson almost secured a location this spring, but investors pulled out due to a last-minute $1 million increase in selling price. “It was heart wrenching,” Jackson said. His outlook is bleak unless “drastic changes” are made.

Despite the lack of new businesses, one of the original D.C. medical growers, District Cannabis, does not share the supply shortage concerns that have been voiced by others in the community. Andras Kirschner, one of the founders of District Cannabis, said that his cultivation is permitted and “shovel ready” for 45,000 square feet of cannabis growth. District Cannabis currently supplies products to most of the medical dispensaries.

“We currently have meaningful excess supply that could support many new stores coming online in the coming months,” Kirschner said. He also pointed to two large cultivation centers entering the market that will have product ready by late fall.

“The illegal operators use this as a delay tactic to transition to the legal market. They say if we transition there will not be enough supply. But there is plenty of supply and new growers coming online,” Kirschner said. D.C.’s medical market has not sold over 400 pounds of cannabis in months.

As far as the impact of the zoning change on new businesses opening, Kinner said it is hard to know if this zoning change will be enough to make a difference.

“Expanding the permissible zones does not necessarily equate to more real estate options for medical cannabis operators,” she said. “Property owners still have to play ball.”