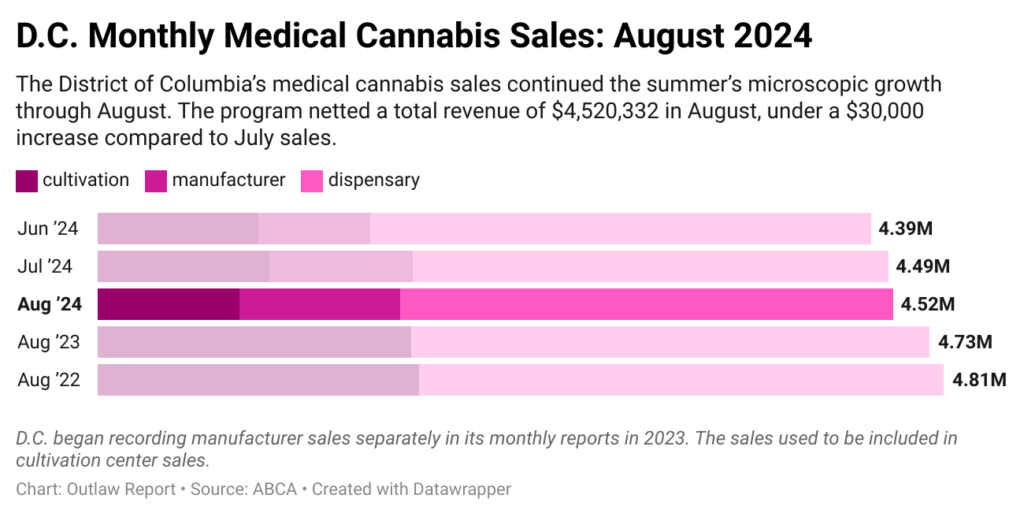

The District of Columbia’s medical cannabis sales continued the summer’s microscopic growth through August. The program netted a total revenue of $4,520,332 in August, under a $30,000 increase compared to July sales. This small rise was paired with hundreds of more patients served, showing that the market is still struggling to grow and that the growth is not in concert with the new retail location expansions.

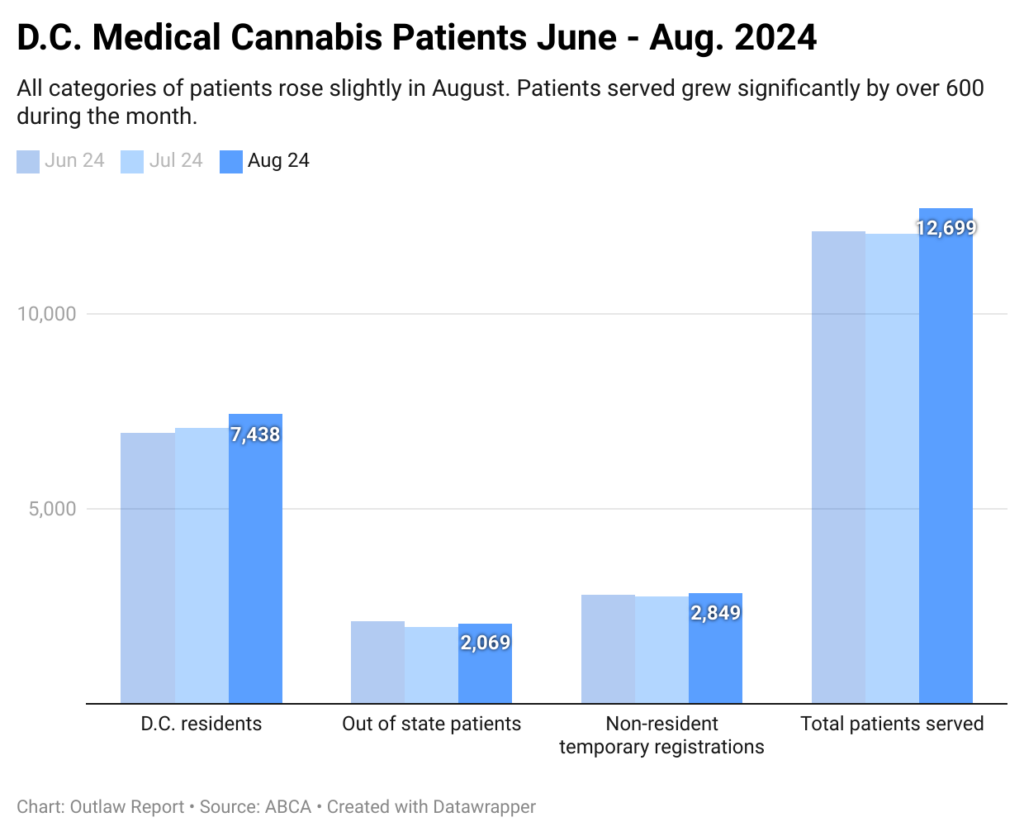

Total patients served rose by over 600 which shows a significant increase from March 2024 where only a little over 10,000 patients were served. With the padlocking of unlicensed gifting stores beginning in September, it is unclear yet whether enforcement will have an impact on legal D.C. market sales.

D.C. lost over 2000 registered patients overall during August. However, the number of patients served rose by over 600 people. That rise was largely driven by D.C. residents not out of state patients or temporary registrations. D.C.residents served grew by almost 400 people.

Dispensary sales rose by about $100k in August for D.C.’s medical cannabis program totaling $2,804,301 split over almost ten dispensaries. August 2024 sales are still below June 2024 and the lowest for the month in the last four years. August cannabis producer sales also fell well below the last four years average for the same month.

The one bright spot was a steep increase in cannabis bud sold. For the first time in months actual flower bud sold was over 400lbs at 462 lbs bought.

- Manufacturer sales eclipsed cultivation sales by almost $100k in August, demonstrating the dominance of non-flower cannabis products.

- 3,655 patient registrations are set to expire in the next three months.

- Virginia, Maryland and North Carolina continue to be the top temporary registration states.

- There were four scheduled inspections with no violations found.

- 2,580lbs of cannabis waste was destroyed in August.

- Infused prerolls sold in August almost doubled from July. (2.7lbs)

- Almost 9,000 vape cartridges were sold as a steady increase in sales continues.

- Concentrate and non-infused preroll sales fell in August.